This blog is dedicated to describe normal accounting Public : auditing practices

#99- Inventory System - Perpetual vs Periodic

Under perpetual method:

- the entity record for every single movement of the inventory (i.e. in and out of the inventory)

- at any single point of time, the entity is able to recall the inventory on hand

- frequency of stock-take required is lesser than those accounted using periodic method

Under periodic method,

- every single movement for the inventory (i.e. in and out) is not required to be tracked

- the entity perform a periodic stock-take to ascertain the inventory balance

- inventory on hand can only be recalled after the stock-take is performed

- frequency of stock-take required is higher than those accounted using perpetual method

- cost of sales is computed by using the following formula: Opening Stock+ Cost of Goods Manufactured / Purchase - Closing stock

The above summarize the difference between perpetual inventory method and periodic inventory method.

Ernst & Young sued over Lehman's collapse

One of the Big 4 accounting firms, Ernst & Young is facing a civil lawsuit in the US over the collapse of Lehman Brothers! New York's state attorney Andrew Cumo claims that New York's state attorney Andrew Cuomo claims Ernst & Young "sat by silently" as Lehman Brothers tried to conceal billions of dollars in debt from investors before its implosion. The lawsuit says Lehman ran a "massive accounting fraud".

It is claimed that Ernst & Young approved of Lehman's increasingly frequent use of a device known as Repo 105. The lawsuit alleges: "These Repo 105 transactions had no independent business purpose and were designed solely to enable Lehman to manage the company's financial balance sheet metrics."

The case centres on Lehman's use of an accountancy practice known as Repo 105, which involves temporarily removing money from the balance sheet to give the impression of greater financial strength. Mr Cuomo mentioned that, Ernst & Young should not have approved the accounts, knowing that the practice had been used so widely.

The lawsuit seeks more than $150 million in fees that Ernst & Young received from 2001 to 2008 as Lehman's outside auditor,plus other unspecified damages

Ernst & Young has responded, and claims that the firm is going to "vigorously defend" the lawsuit.

#98- Expectation on FY 2010 inventory level

In view of the recovering business/ economy, inventory turnover are expected to become relatively quicker than prior year. Aged inventory are expected become relatively lesser either.

If the inventory level, as well as aged inventory level, remain relatively constatnt as prior year, this could indicate higher risk of provision for inventory obsolescence. Auditor should discuss this issue with management.

#97- Excess inventory after christmas

One of the options suggested was to auction it off online. Companies tend to store higher level of inventory during Christmas season, to meet the demand from customers. Demand from customers are often hard to be projected. Neither historical trend, nor forecast can precisely predict the inventory required. Hence, instead of losing sales resulted from insufficient inventory,Companies tend to store higher level of inventory to meet the demand from customers.

After Christmas sales, Companies are required to reduce the relatively high level (if any) of inventory, considering that the warehouse costs/ inventory holding costs/ liquidity costs could be substantial.

One of the options suggested was to auction the inventories off online. Though the pricing might not be attractive, but auctioning off the inventories allow the Companies to reduce all type of costs mentioned above.

Companies could sell the stocks in all sorts of website, including: e-bay.

Impact on Accounting Education

Accounting is considered to be the language of business. The number of globalized businesses in the world is vast and increasing, which emphasizes the importance of achieving a common accounting language. Accounting is predominantly known as the profession that analyzes the past, but because of globalization it is important to look into the future.

As a result, it is important to educate the accounting field on the standards of other countries. The IRSF was created by the International Accounting Standards board. The Financial Accounting Standards Board created the generally accepted accounting principles.

Accounting is predominantly known as the profession that analyzes the past and looks into the future. Globalization plays a huge role on accounting education. Thus it is more important to educate accountants on the standards of other countries, so that they are knowledgeable in their field because many businesses operate with countries across the world.

The accounting education is more important in such a way that the accountant becomes a part of the management and decision-making team, rather than just providing the financial information. Accounting in the future will require not only specific knowledge but also must also be able to change with the globalization. Accountants will need to be well prepared in computer skills, the ability to learn new software and new accounting rules.

Realizing the importance of information technology most of the colleges and universities have added a new track called Accounting Information System. The Professional accountants employ extensively in the computer applications to perform their tasks such as email to communicate, Internet for search, and accounting software to record and analyze financial transactions for decision-making. Computerized accounting systems have now replaced manual accounting systems in most of the organizations.

Significance of Accounting Payroll

Payroll Accounting is important for an Employee and the Employer, which deals with the payment of your employees and paying the appropriate taxes to the government. The payroll system is the most frequently updated part of financial record in most of the organizations. Nowadays even a small business can manage this system with the online processing sites.

Payrolls are considered to be the lifeline of any organization. It consists of procedures and mechanisms ensuring that an accountant processes the employee salary information in complete manner with accuracy. Also allows the business owners to create a function that is easy for them to understand and use. Usually small businesses run their payroll systems like that of the larger organizations.

In many organizations there are several pension plans, offered to their previous employees based on the duration and the importance of their responsibilities. It is very important for an organization to maintain and manage their payrolls. If the payrolls are kept by the organization in an efficient manner, it would keep the employees, in the healthiest state of mind.

If there is any occurrence of issues in the payrolls of the company, then it may lead to the employee dissatisfaction having a direct bearing on the efficiency of their services. Thus the Payroll accountant has to take care of the payrolls right from the salaries and wages such as paid vacation, insurance coverage of the company. They must properly integrate the pay records with the payroll and the benefit systems.

A manual payroll system requires that the payroll to be processed by hand and is therefore a considerably slower procedure. But an automated payroll system enables the employer to process its payroll through a computerized system which makes the process faster by reducing the errors that occurs in manual system. This may be considered as one of the demerit that the employer must invest in for the payroll software and maintain it.

Accounting principle- Accrual Basis

In finance, cash basis figures are more relatively more valuable , as compared to accrual basis ( advocated by accounting principle), in order to value a business.

What do you think ? You prefer a an accrual method or cash method in valuing a business?

Auditing Creditors- Creditor Turnover Analysis

Creditors' turnover anlaysis is one of the auditing procedure we performed. What are we expecting from the audit client, in general. We expect the creditors turnover (days) to increase, as compared to prior period.

To illustrate, majority of our audit clients are affected by the economy turmoil. They are squeezing suppliers' credit ( by delyaing the repayment), in order to maintain the Company's working capital, as our audit client's working capital are most likely affected by the delay of repayment from customers.

We have formed an expectation, and we will compare the actual result with our expectation. Any unusual movements need to be identified.

Auditing: Annual Budget vs Actual Results

Budget has incorporated management's forecast, estimation and outlook of the business in the coming times.

Is management's budget useful to auditor?

The answer is yes. Budget, which represents management's expectation, should be compared against the actual results. Significant variances should be investigated. Apparently, management would have to explain the variances. It's important for auditor to find out the reason of the variances to identify potential changes in business operation, significant developments during the year.

Understanding how management view the business (by looking at the budget) is a crucial stage in audit planning, it enhance our knowledge and understanding on the business, the industry and the overall economy as a whole.

Disposing capital-intensive business

Capital-intensive require heavy investment of resources, including, but not limimted to: cash, human resource,management's effort, etc. As part of the restructuring exercise to scale down, there are evidence that a lot of corporate are disposing off capital-intensive business.

How would disposing capital-intensive business benefit the corporate?

- immediate liquidity ( i.e. proceeds from disposal)

- better working capital management

- allow management to evaluate other business opportunities

- lesser resources are required, which allow the business to scale down

- higher return on asset ("ROA") ratio

However, it's always not easy to dispose off a capital-intensive business unit/ busines during this business environment, unless a substantial discount is given to the potential buyers.

Accounting treatment for tax penalty

" How should penalty on late repayment for tax been accounted for?"

Should it be a tax expense? Should it be other expenses?

To clarify: penalty imposed by inland revenue authority on late repayment for tax should not be accounted for as tax expense; it should be accounted for as administrative expense/ other expense.

No depreciation charge on asset held for sale

To illustrate, Company ABC entered into Sales & Purchase agreement with 3rd party to dispose one of its property. The Sales & Purchase agreement may take months to complete. In this instance, Company ABC re-classified the property from Property, Plant & Equipment to Asset held for Sale upon entering the Sales & Purchase agreement.

Asset held for sale is de-recognised from the balance sheet upon the completion of the Sales & Purchase agreement.

Auditing Creditors

In normal business circumstances, suppliers will send their monthly Statement of Account to their customers to inform the customers in relation to the outstanding balances. Hence, our audit client will , most likely, receive statement of account from the suppliers.

As part of audit procedure, we can check the suppliers' statement (received by our audit customers) against the creditors' balance recorded in their book. Discrepancies need to be investigated. Statement of account served as an external confirmation to check if our audit client's book has been prepared properly.

However, there are suppliers who do not have practices of sending out Statement of Account to their customers. In this instance, we can send external audit confirmation to the suppliers to confirm outstanding balances.

Cash audit- internal controls in cash process- cash payment

Auditors may consider test the internal controls of the client's cash process. For this entry, we will provide an overview of the possible audit procedures to test the internal controls in cash payment process:

(a) select certain number of random samples, and test that payment voucher are properly prepared and authorised

(b) select certain number of random samples, and test that bank reconciliations are properly prepared and reviewed

(c) select certain number of random samples, and test that journal entries are properly posted into General Ledger

(d) select certain number of random samples, and test that payment voucher details match with the corresponding payment details

The Types Of Accounting

Pursuing a Career in Accounting? Opportunities Are Yours For the Taking

o Previous experience in accounting or auditing, such as experience gained in summer or part-time internship programs, will help your chances of getting an accounting job.

o Knowledge of computers and financial software applications will make you a stronger candidate for an accounting job.

o be proficient in math and you must have excellent analytical skills

o communicate effectively

o be good at working with people

o have basic accounting knowledge

o be familiar with accounting software

o American Institute of Certified Public Accountants

o National Association of State Boards of Accountancy

o Institute of Management Accountants

o Accreditation Council for Accountancy and Taxation

o The Institute of Internal Auditors

o ISACA

o Association of Government Accountants

Should I Practice Public Or Private Accounting

#96- Cash audit- internal controls in cash process- cash payment

Auditors may consider test the internal controls of the client's cash process. For this entry, we will provide an overview of the possible audit procedures to test the internal controls in cash payment process:

(a) select certain number of random samples, and test that payment voucher are properly prepared and authorised

(b) select certain number of random samples, and test that bank reconciliations are properly prepared and reviewed

(c) select certain number of random samples, and test that journal entries are properly posted into General Ledger

(d) select certain number of random samples, and test that payment voucher details match with the corresponding payment details (e.g suppliers' invoices), etc

#95- Auditing Creditors IV

- Review of Creditors' Statement of Account

- Purchase Cut-off testing

- Comparison of current year balance to prior year balance

In addition to the above, it would be good if a creditors' turnover analysis is performed:

Creditors Turnover (day): Purchase/ Average Trade Creditors x 365 [for periodic inventory system]

Creditors Turnover (day): Purchase/ Average Trade Creditors x 365 [for perpetual inventory system]

Auditor can compare the creditors' turnover (day) computed above to general creditor term given by the creditors to assess if the Company has been repaying on time. If the creditors' turnover (day) is significantly longer than the credit term given by suppliers, this might indicate the liquidity issue the Company is facing.

#94- Auditing Creditors III

(i) Review of Creditors' Statement of Account

(ii)Purchase cut-off testing [ Please also refer to interesting comments posted by our readers

Apart from the procedures mentioned above, auditor should also perform analytical review, by comparing current year creditors' balance to prior year creditors' balance to investigate if there's any unusual fluctuations or absence of expected fluctuations.

For instance, sales volume for ABC company reduced substantially during the year, while the trade creditors balance has increased significantly. We need to understand / analyse the reasons caused the increase in trade creditors' balance while the sales volume has dropped substantially. One of the possible answer is due to the ABC Company is having liquidity issue, and resulted in delaying in repaying its trade creditors.

A good and thorough analytical review give auditor a better understanding of the business.

Closing of Account in Numia

1) Select Company -> Close Numia Account.

2) A new window will be opened similar to the screenshot as below.

3) By clicking the "Close Account" Button, Your account will be closed.

3) By clicking the "Close Account" Button, Your account will be closed.As soon as you closed your account, You are not logged out immediately. You may manage your accounts even now too and it will be audited as before.

If you want to reactivate your account with Numia, You will be given a period of 48 hours or 2 days (from the time you closed your account) to login again. You or the persons linked with this account can login to the website within this stipulated period of time to activate your account.

After the deadline given by Numia to reactive your account is completed, Your account will be permanently closed. You can contact support@numia.biz for retrieval of your accounting records or any kind of assistance.

Banking Registers

Numia, online accounting software not only helps you to record your accounting transactions or maintain your banking records, but also enables you to edit or delete the transaction. You can view the report of the transactions each and every bank separately within your desired time period.

The steps involved are as follows:

• Select Bank-> Banking Registers.

• Select the bank name to view the accounting transactions in that specified bank.

• Select the account name.

• Now you can view the list of transactions made in that bank in the corresponding account name.

• Edit or delete the transaction by just clicking the edit or delete icons which is viewed by moving the cursor over the transaction.

• You can also customize the report by clicking “Customize” option. Customizing allows you to view the transaction report within specified dates and to differentiate the transactions based on reconciliation.

• You can also export the report to “Excel spreadsheet” or simply print it.

Exporting your Report to Excel Spreadsheet

1.Select Report -> Choose the report you want to export.

2.Click “Excel Spreadsheet” Button.

3.Choose “Save file”.

4.Select the folder where you want to save the file. You can also change the name of the file.

5.Open the file in excel and make the changes you want. This change does not affect the data in the Numia reports.

The screenshot is as follows.

Ebay Transactions :

The basic working of Ebay includes two factors such as Bidding and Buy it now.

•A seller can list any kind of item like antiques, cars, books, sporting good and almost everything on Ebay.

•The seller has to decide whether he prefers bidding by accepting bids on the item or he may choose buy it now option to make the buyers to buy the item right away at a fixed price.

•In the bidding method, the auction is opened by the seller for some price and it remains in ebay for certain number of days. Then, the buyers are allowed to place the bids on the item. When the specific period ends, the buyer with the highest bid will win.

•In Buy it now option, the buyer who accepts the seller’s price at first gets the item.

Numia, the online accounting software is making lots of improvements with simpler accounting modules, each aiming to make this accounting software better and easier to use. In the path of development, Numia’s future plan is to include the access to Ebay transactions to make the accounting processes in a effective manner.

Sending Report Through Email

Numia provides a simple way of sending any report to multiple email ids in a easier way. The steps involved are as follows.

• Select Reports -> click the report you want to get emailed.

• Click "Email" option.

• Email form will be shown.

• Enter the email address to which the report has to be send.

• You can also enter the message, if you wish the report to be sent with the message.

• Then by clicking "Send Report", Your report will be sent.

#93- Auditing Creditors II

As an auditor, we can examine the Goods Received Notes ("GRN") near year-end and after year-end to check that Goods Received Notes details matached with the supplier's delivery order details and supplier's invoices details.

For instance, Auditor Arthur is auditing Company E (whose year end is 30 June 2010) creditor's balance. As part of cut-off testing procedure, Auditor Arthur requested the details of Goods Received Notes near year-end and after year-end. And noted the following sample:

"Goods received notes was generated on 01 July 2010, however, supplier's invoices, supplier's DO indicated the date of 30 June 2010. Further investigation revealed that, supplier generated their internal documents on 30 June 2010, but only delivered the goods to Company E in 01 July 2010. As such, there's no exceptions for Company E"

Cut-off testing is deemed as a compulsory procedure in auditing creditors' balances.

Memorized Reports

Numia provides a better way to memorize your reports to have them for future reference. By memorizing, it gets saved automatically in the Memorized Report List. Then, when you want to create a similar report, you can go to the Memorized Report List to find it.

The steps involved in memorizing a report are

* Click Reports -> Select the specific report you want to memorize

* Click the "Memorize" Button.

* Enter the title under which the specified report is going to be memorized

* By clicking Memorize button, the report will be saved.

* You can view, edit or delete the memorized report by selecting Report -> Memorized Reports.

Adding and deleting accounts using chart of accounts

In Numia, the common accounts used across the world for small and large businesses have been listed in Default accounts. In case if you find that your accounts is not listed in default accounts, you can add new accounts. If you need more accounts or sub accounts other than the 'Default accounts', then you can create your own accounts by clicking 'Add new' Button at the page. Just follow these steps to add new account type or account name.

Adding Accounts :

- Go to Banking menu and then select Chart of Accounts.

- Now you can view the list of default accounts and user created accounts.

- If you have not created any accounts then only defaults accounts are listed.

- Click the “Add New” button to add new account type and account name.

- Fill the details like account no, account section, description then click Add Type button.

- Now you new account type is created. You can view the newly created account type in the chart of accounts main page.

- You could also have the provision of editing your user created account types. Just click the edit button in the Chart of accounts page. Then you can change the account type of the existing accounts. But you can't edit the default accounts.

Deleting Accounts :

It is possible to delete your existing accounts in Numia. In “Chart of accounts” page the default accounts and the user created accounts are listed. Just click the delete button corresponding to the account type you need to delete. But once you deleted the account, it is not possible to recover it or view it.

Reversing of Transactions

When the transaction is reversed, the system will create a new transaction that simply reverses the original transaction debits and credits. In Numia, the Online accounting software, Reversing the transaction can be done by following the steps below.

• Choose Report -> Transaction List.

• Select the transaction that need to be reversed.

• Click on the “Reverse” Button to reverse the transaction.

Editing and Deleting of Full and Partial Payments

Numia, the online accounting software provides a simple way to record partial payments from your customers. The steps involved in recording partial payments are

• Select Customer -> Receive Payments.

• Choose the customer from which the partial payment is received.

• Select the Payment mode from either cash, cheque or credit card.

• To deposit the payment amount to any of the bank, choose the bank in the “Deposit the amount to field”

• To keep the "Cash In Hand", don't select any option.

• If you want to keep the cash in a fund to deposit later, select Group with Undeposited Funds.

• Choose the invoice for which you have received the partial payment.

• Enter the partial amount paid in the Amount Paid field.

• Click Submit to record partial payment from the customer.

Now, in Numia, you can easily edit, delete the partial and full payments on customer and vendor transactions and do a complete edit / delete of any reconciled / un-reconciled transactions. This can be done by selecting “Reports -> Transaction List”. In the transaction list, just select the transaction to which change has to be done. You will be redirected to the form. Now you can edit and after clicking “Save changes”, your changes has been saved. Numia will automatically add to the credit if you change the amount. You can also delete the transaction by clicking “Delete”.

Hewlett Packard CEO Mark Hurd- False Expense Report

HP said that althorugh there was no violation of its sexual harassment policy, Mard Hurd violated the company's standards of business conduct by submitting inaccurate expense reports that covered his relationship with the contractor.

HP further claims that Mark Hurd had "...failed to disclose a close personal relationship he had with the contractor that constituted a conflict of interest, failed to maintain accurate expense reports, and misused company assets. Each of these constituted a violation of HP's Standards of Business Conduct..."

It is evidenced that HP has a strong corporate governance that guide / regulate the behaviour of its mangement, employees, or every single on within the firm.

#92- Auditing Creditors

In normal business circumstances, suppliers will send their monthly Statement of Account to their customers to inform the customers in relation to the outstanding balances. Hence, our audit client will , most likely, receive statement of account from the suppliers.

As part of audit procedure, we can check the suppliers' statement (received by our audit customers) against the creditors' balance recorded in their book. Discrepancies need to be investigated. Statement of account served as an external confirmation to check if our audit client's book has been prepared properly.

However, there are suppliers who do not have practices of sending out Statement of Account to their customers. In this instance, we can send external audit confirmation to the suppliers to confirm outstanding balances.

Deciding Between Bookkeeping Software and Bookkeeping Service

Bookkeeping - the record of day to day financial transactions such as sales, purchase, income and payments by an individual or an organization. These records needed to be produced at the end of every financial year. From small to medium to large business, maintaining financial records is a mush which therefore necessitates bookkeeping process.

The choice of preparing and producing the accounts: organization basically have three options: one is to prepare and maintain records manually; next can be to employ the bookkeeping services and the last option is to use bookkeeping software system.Each has its own advantages and disadvantages. What ever may be the employed method, the ultimate thing is to produce accurate accounting information needed on time.

As the recorded financial transaction is very important for financial decisions and knowledge over the business performance, efficiency and accuracy over the recorded transactions becomes the major concern. Further, the accounting information is the accumulation of documents such as sales invoices, purchase invoices and possibly bank records during the financial year and after the end of the financial year for tax purposes.

Improper records of the above said data (as financial records) leads to unwanted penalties, simply administrative burdens. In analyzing the choices: keeping and maintaining manually may lead to data lose, inaccuracies, fines and penalties thus leading to severe issues at the end of the financial year.

Manual bookkeeping needs regular and periodic evaluation of the data. In going for the choice of having a bookkeeper, trust and knowledge over the operation becomes the mandatory thing for any organization. Also periodic and regular tracking of the works and records maintained is necessary. Having bookkeeper, it is also partially includes in manual work where accuracy level is still depends on the knowledge of the bookkeeper.

The third choice of installing bookkeeping software also has few disadvantages. But these are overruled by its wide advantages. The major advantage is the reduction in paper work and 90% of reducing the manual work thereby achieving accuracy and efficiency. By having bookkeeping software, no one other than the business owners and the authorized person know the financial status which can be called as the security over the accounts.

So by having the gist in hand, the advantages and disadvantages over the choices can be analyzed as discussed above. It can be said with proof that accounting software provides better financial control and performance over the others: manual bookkeeping and having bookkeeper. Thereby administrative burden can be reduced and the organization can focus on its core activities.

How your bookkeeping can boost your tax deductions

Get reimbursed for business expenses that you pay for personally.

Have you ever been to a restaurant that only takes cash? Or traveled in taxi that only accepts cash? Or have you misplaced your business credit card and had to use your personal credit card? These are just some examples where we have to pay our business expenses with personal funds. We could easily miss these expenses so keep an file handy and put all of your receipts in that file. So that you have got a handy report that you have spent from your personal fund.

Have separate account for code meals that are 50% deductible in order to keep them distinct from other expenses that are not subject to this 50% rule. Many times we could see just one meal account in the chart of accounts. The problem with this is that while meals are generally only 50% deductible, some meals are 100% deductible. The mistake that we see most often when reviewing a prospect's prior year tax return, is all meals are treated as only 50% deductible (because they are all coded to one account) and we don’t have any strategy to identify meals that are 100% deductible.

Always maintain your travel expenses separately from your meals and entertainment expenses. As business travel is 100% deductible so separate it out as part of your bookkeeping system. Otherwise, you will have to sort through that account at the end of the year, or worse, you may sometimes forget to sort through that account and everything in the account is treated as only 50% deductible!

Use a separate section in your online bookkeeping software to make notes about who, what, when, where, how much and the business purpose of your travel, meals and entertainment expenses. By proper bookkeeping it is easy to boost your tax deductions, particularly for travel, meals and entertainment. This is an area where deductions are regularly missed and not properly documented, but once you know the rules and use my system, you'll find more and more deductions.

#91- No depreciation charge on asset held for sale

To illustrate, Company ABC entered into Sales & Purchase agreement with 3rd party to dispose one of its property. The Sales & Purchase agreement may take months to complete. In this instance, Company ABC re-classified the property from Property, Plant & Equipment to Asset held for Sale upon entering the Sales & Purchase agreement.

Asset held for sale is de-recognised from the balance sheet upon the completion of the Sales & Purchase agreement.

#90- Review of Credit Term

To illustrate, we can obtain list of trade debtors, including: credit term given to respective trade debtors, and compare the credit term given to the norm of the industry. We would inquire our audit clients, if credit terms given are unusually long.

For instance, the norm of the credit term in industry A is 90 days. ABC company ( our audit client) allows a credit term of 180 days to customer XYZ. We will have to find out the underlying business reason of giving relatively longer credit term, and evaluate the collectibility of amount owing from customer XYZ.

Analyzing credit term given can be used as a useful tool in understanding the credit policy of our audit client.

Reporting Trial Balances in Numia

The main objectives for preparing trial balance are

• To check arithmetic accuracy.

• To help in preparing Financial statements.

• Helps in locating errors.

• Helps in comparison

• Helps in making adjustments.

In Numia, Online accounting software, You can get the trial balance report easily, showing the debit and credit balances of each account in the chart of accounts. The screenshot for trial balance report in Numia is shown below:

The steps involved are as follows.

• Choose Reports-->Reports review-->Trial Balance.

• The report shows the credit and debit balances for each account.

• You can restrict the report details by selecting dates.

• You can either print the report using print option or export the report to Microsoft excel sheet. You can also able to email it or memorize.

Payroll Accounting in Numia

Online Accounting software, Numia provides you an easier way to calculate and to keep track of the payroll informations of your employees. Add your employee details by entering the required informations. Once you have added the pay tax, pay schedule and deductions of your company, you can easily add payroll for each and every employee. The Screenshot in Numia for adding payroll is shown below:

It can be done by following these steps.

• Choose Add Payroll from the Employee menu.

• Choose the pay schedule for the employee.

• Select the Employee name and enter the rate and quantity for the payroll.

• The net pay will be calculated automatically.

• Click “Add Payroll” to save the payroll created for that employee.

You can also create paychecks for each employee by selecting bank name, account name and entering the check number.

#89- Accounting treatment for tax penalty

" How should penalty on late repayment for tax been accounted for?"

Should it be a tax expense? Should it be other expenses?

To clarify: penalty imposed by inland revenue authority on late repayment for tax should not be accounted for as tax expense; it should be accounted for as administrative expense/ other expense.

#88 PWC Singapore issued Disclaimer Audit Opinion for Rickmers Maritime

For our Accounting & Auditing readers, you can find media coverages on this matter via website. For now, let's look at what's a Disclaimer Audit Opinion.

According to Singapore Auditign on Standard (SSA 701),

"13. A disclaimer of opinion should be expressed when the possible effect of a limitation on scope is so material and pervasive that the auditor has not been able to obtain sufficient appropriate audit evidence and accordingly is unable to express an opinion on the financial statements. " (Source: Singapore Auditing Standard)

As above, a disclaimer audit opinion indicates that the auditor is unable to express an audit opinion on the Group's financial statement.

Example of limitation of scope mentioned above is also quoted in SSA 701:

"17. A scope limitation may be imposed by circumstances (for example, when the timing of the auditor’s appointment is such that the auditor is unable to observe the counting of physical inventories). It may also arise when, in the opinion of the auditor, the entity’s accounting records are inadequate or when the auditor is unable to carry out an audit procedure believed to be desirable. In these circumstances, the auditor would attempt to carry out reasonable alternative procedures to obtain sufficient appropriate audit evidence to support an unqualified opinion."

In the case of Rickmers Maritime, due to the doubt on the ability in obtaining waiver for breach of loan covenant and contingent liability arising from unfulfilled capital commitments, PWC has issued a Disclaimer Audit Opinion.

Vendor payments through credit

You can either record the payment for a single vendor or multiple vendors. If you wish to pay only a part of bill through credits and the rest by other means, you can enter the amount to be reduced from your available credits in the "credits" box and the rest amount in the "Pay Amt" box.The credits will be applied automatically.

Numia provides Help Links for each task. These Help links are very much useful to record the transactions without any queries.

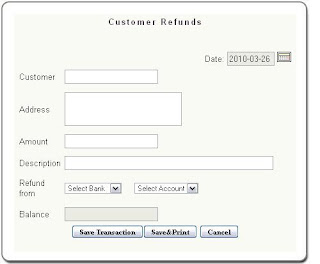

Giving refund for a prepaid order

There may be many reasons for the order to repel. But the thing is that, it is a bit hard to maintain the accounts for a prepaid orders. We may really feel chaotic to tally the money, which has to be refunded. Numia provides an easy option to manage this issue.

It has a form for "Customer Refunds". Just enter the details mentioned in the form.

If you have any queries regarding the "Customer Refunds" form, Help links "Giving refund for a prepaid order " is available for it. The help link explains you, each and every step to proceed the task.

Do Transactions From Your Mobile Phones

SMS Transaction is a service that Numia offers to its customers to get their own company data and add some kind of transactions into their numia account using SMS from mobile phones. For some reasons we offer this service only to U.S phone numbers. Will make it world wide in future soon.

This service makes your job easier, it helps you to do transaction whenever you want to do. You don’t need to login every time for doing transaction, just it is enough if you send SMS from your mobile number. You can register your mobile number in the user accounts section of Numia.

A user must access from only one mobile number. If your company has registered 2 mobile numbers for the same account, you can access it from both the mobile numbers. You can also customize your desired keywords for various transactions. For example i have customized Chk for check transaction as highlighted in the below screenshot.

If you have registered your mobile number, you can receive text of keywords. Just send Text "numia" to 41411 and you will receive a text of keywords you can use for your numia account or follow the SMS instructions.

Following are the steps for SMS transaction :

- Select Company --> Click Texting/SMS List

- Click Add List.

- Select the transaction type and choose your desired transaction name for that transaction type.

- Then click save transaction.

- Similarly Create your SMS Transaction list.

Once you have customized your transaction list, you can do transaction , on your cellphone itself, You can now send "numia Chk 18 350.00" where "18" is the transaction number on the "SMS Transaction List".

Importing data from Quickbooks

In Numia, the option of Importing data from Quickbooks Online®, enables the user to proceed with the present state of accounts. The new registered user is able to import the Intuit Interchange Format (IIF) files with the help of the below page:

In Quickbooks, the data file (IIF) can be exported by clicking: company -> Export your data -> local copy interview.

Thus, this feature of Importing or exporting data with IIF files helps the users to manage their business accounts effectively in case of shifting from one accounting software to another.

Closing Books

Closing book or closing entry should be done at the end of every fiscal year. After the closing entries have been prepared, the temporary accounts will reflect in retained earnings and an intermediate account called income summary is created from which revenues and balances are transferred to retained earnings account(capital). Dividend or withdrawal accounts should be closed to capital.

Numia, provides you easier way for closing your book, having 2 choices either you can close manually or automatically. You can manually close just by selecting yes in the “Require manual closing of books” option highlighted in the above screen shot. And it closes automatically if you choose no.

Following are the steps for closing of books :

- Select Company --> click preferences.

- Fill the details.

- Select Require manual closing of books as ‘YES’ if you want to close your entry manually.

- Default option will be set to 'NO' which automatically closes the account and adds new entry for the next financial year based on the fiscal month.

Customizing and printing of Invoice in Numia

The steps involved in customizing and printing invoice are

* Select customer -> create invoice.

* Enter customer name, date and address.

* Select product or add new product and enter its rate and quantity.

* Select tax details and deduction rate.

* Enter the due date and click send mail if a mail has to be sent.

* Click on the save and print button.

--> On clicking this save and print button, all your transactions will be saved.

--> On clicking this save and print button, all your transactions will be saved.* It will ask whether you want to customize the invoice or not.

* Click OK to customize the invoice.

* A popup window appears.In that you have the option to upload your company logo to appear in the invoice.

* Choose the fields you want to appear it in invoice and type customer message if any.

* Click submit button.

Now you can see the invoice as you wished. Click Print to print the invoice.